For years, I worked in the trenches of accounting departments, balancing books and making sense of numbers that, on the surface, seemed simple. But once I moved from services and investment industries to high-volume transaction environments like food and beverage (F&B), I quickly realized there’s an invisible problem that haunts finance teams every single day—a problem that’s rarely discussed, but quietly drains resources, time, and mental bandwidth.

As the number of transactions grew, so did the complexity, though it wasn’t obvious at first. Coming from industries where reconciling accounts was relatively straightforward—revenue flowing through a few channels—I thought I had a handle on things. But F&B operates differently. Suddenly, I found myself navigating a maze of multiple sales channels, fluctuating discounts, and payment channels that all operated on their own timelines. What used to be routine became a constant battle to stay on top of an overwhelming amount of data.

I remember digging through transaction after transaction, each one carrying its own quirks—different fees, settlement delays, even payment methods I hadn’t encountered before. It felt like trying to piece together a puzzle, but one where the pieces kept changing. It wasn’t just more work; it was the realization that without a streamlined process, this complexity could derail everything—from cash flow management to strategic decision-making. For me, it became personal because I saw how this hidden problem was eating away at the time and energy of the finance team, and it was clear something needed to change.

Growth Foundations for Indonesian F&B Businesses

From a co-founder’s perspective, growing an F&B business presents unique challenges. To scale successfully, businesses need to embrace omni-channel sales strategies. This approach allows them to reach a broader audience and cater to different shopping preferences—whether customers are dining in, ordering through delivery apps, or purchasing via online stores.

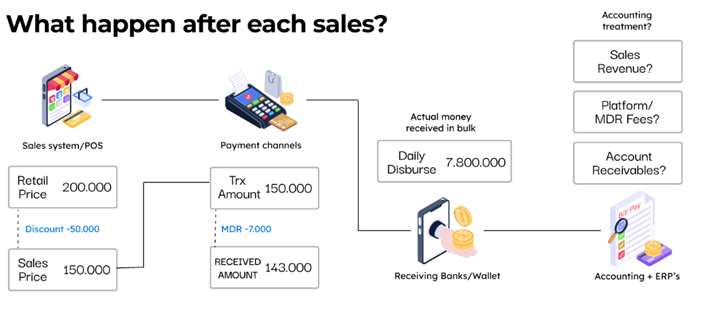

On top of this, offering multiple payment options is essential. Ease and convenience are at the forefront of consumer priorities, and a frictionless payment experience can make or break a sale. Whether it’s through digital wallets, credit cards, or traditional bank transfers, the ability to seamlessly accept payments ensures customer satisfaction. Did I mention that banks often offer special deals for their credit card customers? For business owners, this is essentially free marketing from the bank—how could they say no?

Finally, one of the most critical aspects for founders is having assurance on the availability of cash. Visibility and control over cash flow are vital to ensuring operational stability. F&B businesses often operate with thin margins, so having a clear, real-time understanding of their cash position is crucial for day-to-day decision-making, especially when scaling. Yet, these growth-driven strategies come with an often overlooked consequence: an increasingly complex financial environment that places enormous strain on the finance team. It’s this complexity that leads to the invisible problems I’ve witnessed firsthand—the long hours spent reconciling data across sales channels, payment platforms, and cash flows, often with little help beyond basic.

Growing Pains in Finance Operations

As F&B businesses grow, so does the volume of transactions they handle daily. While growth is every founder’s goal, it directly increases the complexity of accounting tasks. With hundreds or even thousands of transactions being processed through various sales channels and multiple payment channels, finance teams are suddenly faced with an overwhelming amount of data to reconcile.

To make matters worse, these transactions often come from multiple data sources, each from different platforms that power different parts of the business—POS systems, online ordering platforms, delivery apps, and more. Each of these platforms stores data in its own unique format, making it incredibly difficult to aggregate, analyze, and draw insights from. What should be a straightforward accounting process becomes a time-consuming task of manually matching up numbers across systems that don’t “talk” to one another.

In F&B businesses, finance becomes a deprioritized function, often taking a backseat to core product or customer-facing operations. Founders and managers tend to focus on growing the brand, improving the product, and expanding the customer base—understandably so. As a result, growing complexities leave finance teams to handle them with insufficient resources or tools.

The quick fix? Hiring more people who work with spreadsheets to manually process and reconcile transactions. While this solution may work in the short term, it’s a band-aid for a much larger, systemic problem. More people only add to the chaos, increasing the risk of human error and inefficiency.

This method of “more people with spreadsheets” may keep the books balanced temporarily, but it doesn’t scale. The more transactions flow through, the more opportunities for mistakes, delays in reporting, and a lack of real-time insights—all of which can severely impact the business’s ability to make informed financial decisions.

A Better Solution for High-Growth F&B Businesses

I understand the unique challenges faced by F&B businesses as they scale, especially when it comes to managing complex financial operations. Having worked as an accountant myself, I know that the sheer volume of transactions and data coming from multiple sales channels, payment gateways, and platforms can overwhelm even the most seasoned finance teams. That’s why a solution specifically designed to streamline and automate these processes is necessary, where spreadsheet does not cut it anymore.

Ledgerowl platform helps F&B businesses simplify their reconciliation workflows, allowing finance teams to move away from manual, error-prone tasks. With Ledgerowl, businesses can integrate all their sales and payment data into one unified system, no matter how many different platforms they use—whether it’s a POS system in-store, an online delivery platform, or third-party marketplaces. Regardless of which bank you bank with, we cover you.

A Fast-Moving Industry with Hidden Challenges

I’ve seen firsthand how overwhelming it can be for finance teams to keep up with the pace of the F&B industry. What looks seamless to customers—orders flowing in, payments being processed—is often the result of countless hours spent behind the scenes, reconciling transactions and tracking down discrepancies. I remember the frustration of digging through multiple systems, trying to match payments with sales, and knowing that even the smallest error could throw off the entire process. It became clear to me that without the right tools, this complexity only grows. That’s why we built Ledgerowl—to simplify these processes for teams like the one I was part of, giving them the tools to streamline reconciliation and focus on what really matters: growing the business and making strategic decisions, not getting lost in spreadsheets.

Learn more here: https://ledgerowl.com/reconciliation-automation